The American Express Gold Card is one of the most rewarding and versatile credit cards available in the UK. Designed for those who enjoy travel, dining, and exclusive lifestyle perks, it offers generous rewards on everyday spending, making it a favourite among frequent travellers and food enthusiasts. With benefits like airport lounge access, dining credits, and a flexible rewards programme, the American Express Gold Card provides exceptional value for those who maximise its features.

This guide explores everything you need to know about the American Express Gold Card – from how its rewards system works to the benefits, costs, and whether it’s worth keeping beyond the first year. Whether you’re considering applying or already have the card and want to make the most of it, this article will help you navigate its features and potential savings.

What is the American Express Gold Card?

The American Express Gold Card just like the Amex Platinum is a premium rewards credit card designed for individuals who value travel, dining, and lifestyle perks. As one of the most well-rounded rewards cards available in the UK, it offers an impressive Membership Rewards programme, travel-friendly benefits, and exclusive offers on dining and entertainment. With a generous welcome bonus and no foreign transaction fees, it is a popular choice for frequent spenders who want to maximise their everyday purchases.

Who is the American Express Gold Card Best Suited for?

The American Express Gold Card is ideal for those who:

- Spend regularly on dining, travel, and retail purchases.

- Want to accumulate rewards points that can be redeemed for flights, hotel stays, and shopping vouchers.

- Travel frequently and appreciate benefits like airport lounge access and no foreign transaction fees.

- Enjoy exclusive lifestyle perks such as dining credits and retail discounts.

- Are willing to pay an annual fee in exchange for premium benefits.

Key Features

- Earn Membership Rewards points on all purchases, with enhanced earning rates for dining and travel.

- First-year annual fee waived (£195 from the second year onward).

- Complimentary airport lounge access via Priority Pass.

- £120 annual dining credit at select UK restaurants.

- Travel insurance coverage for peace of mind while abroad.

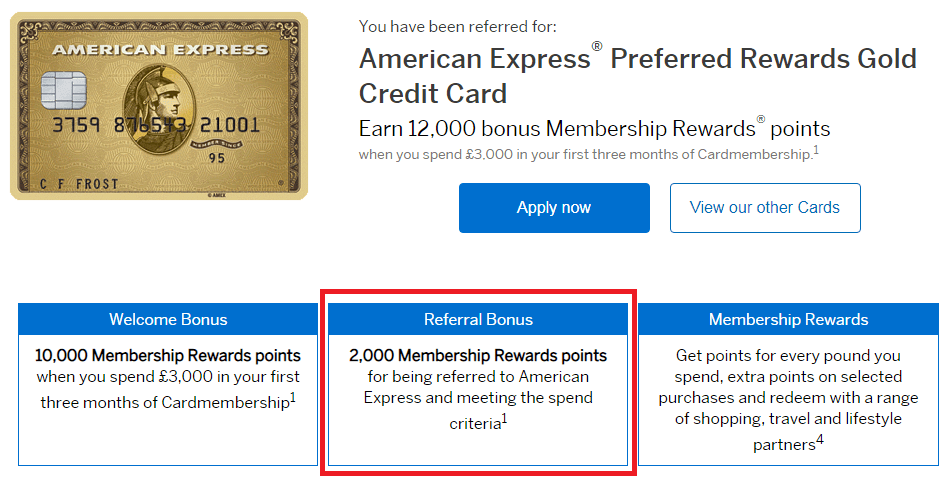

- Strong welcome bonus for new applicants.

- No foreign transaction fees, making it an excellent choice for international spending.

- Access to exclusive Amex Offers for discounts on shopping, dining, and travel.

American Express Gold Card Benefits

Generous Rewards Programme – How It Works

The American Express Gold Card offers one of the most flexible and valuable rewards systems in the UK. By using the card for everyday spending, cardholders can accumulate Membership Rewards points that can be redeemed for a wide range of rewards, from travel bookings to shopping vouchers and statement credits.

Earn Rates by Spending Category

- 3X points for dining at restaurants in the UK and worldwide.

- 2X points for flights booked directly with airlines or via American Express Travel.

- 1X point for all other purchases.

- Additional bonus points can be earned through targeted Amex Offers and special promotions.

How to Redeem Membership Rewards Points

Cardholders can redeem their accumulated points in a variety of ways, including:

- Statement credits: Offset the cost of purchases by redeeming points against your balance.

- Gift cards: Choose from major retailers such as Amazon, Marks & Spencer, and John Lewis.

- Travel bookings: Use points to pay for flights, hotels, car hire, and experiences via Amex Travel.

- Shopping rewards: Redeem points for items through the Amex Membership Rewards online store.

- Transfer to airline and hotel partners: Convert points to travel loyalty programmes for added flexibility.

Transfer Partners – Converting Points to Airline Miles & Hotel Rewards

One of the biggest advantages of the American Express Gold Card is its extensive list of airline and hotel transfer partners, allowing you to convert Membership Rewards points into airline miles or hotel loyalty points for greater redemption flexibility.

Some of the top transfer partners include:

- British Airways Executive Club (Avios) – Ideal for short-haul and long-haul flights with British Airways and Oneworld partner airlines.

- Virgin Atlantic Flying Club – Great for premium cabin redemptions on Virgin Atlantic and partner airlines.

- Hilton Honors – Convert points to redeem for free hotel nights at Hilton properties worldwide.

- Marriott Bonvoy – Use points for luxurious stays at Marriott hotels globally.

- Singapore Airlines KrisFlyer, Emirates Skywards, and others – Additional airline partners for international travel redemptions.

Travel Perks and Airport Benefits

Complimentary Lounge Access with Priority Pass

As a Gold Cardholder, you receive four complimentary visits per year to over 1,300 airport lounges worldwide through Priority Pass. This perk provides a quiet and comfortable environment to relax before your flight, complete with complimentary food, drinks, and Wi-Fi.

Travel Insurance Coverage – What’s Included?

The Amex Gold Card comes with built-in travel insurance, offering essential coverage for peace of mind when travelling abroad. Coverage includes:

- Travel accident protection – Cover for accidents while travelling.

- Delayed flight and baggage coverage – Compensation for flight delays or lost luggage.

- Medical expenses abroad – Coverage for emergency medical treatment while travelling.

No Foreign Transaction Fees – A Great Card for Travellers

Unlike many UK credit cards, the Amex Gold does not charge foreign transaction fees when spending abroad. This makes it a fantastic choice for those who frequently travel internationally and want to save on extra charges.

Dining & Lifestyle Benefits

£120 Annual Dining Credit – How to Use It

The Amex Gold provides £120 in annual dining credit, split into £10 per month, which can be used at select UK restaurants. To redeem, simply pay with your Amex Gold Card and receive an automatic statement credit.

Uber Cash Perks – Monthly Travel Savings

Cardholders also receive £10 in Uber Cash each month, usable on Uber rides and Uber Eats, helping you save on transport and dining.

Extra Amex Offers & Discounts on Travel, Retail, and More

American Express Gold Card provides exclusive deals across major brands, including hotel discounts, cashback offers on online shopping, and savings on travel bookings.

Costs, Fees, and Limitations

Annual Fee – First Year Free, But Is It Worth Paying Later?

The American Express Gold Card is free for the first year, but costs £195 per year thereafter. Whether it’s worth keeping depends on how much you take advantage of the rewards and perks.

Other Fees to Consider (Late Payment, Cash Withdrawals, and More)

- Late payment fee: £12 if you miss a payment deadline.

- Cash withdrawals: 3% or £3 (whichever is greater).

- Interest rate: A variable APR applies on unpaid balances.

Foreign Exchange Fees and International Spending

The Amex Gold does not charge foreign transaction fees, making it ideal for frequent travellers.

Final Verdict – Is the Amex Gold Worth It in 2024?

The Amex Gold remains one of the top travel and rewards cards in the UK. It offers excellent earn rates, valuable travel perks, and generous dining credits.

If you regularly take advantage of the benefits, the £195 annual fee can be worthwhile. However, if your spending habits don’t align with the card’s perks, consider downgrading or switching to another card.

Best Alternatives if This Card Isn’t Right for You

- Barclaycard Avios Plus: Great for earning Avios with British Airways.

- Virgin Atlantic Reward+ Card: Ideal for those who fly with Virgin Atlantic frequently.

- Amex Platinum: A more premium option with additional travel and lifestyle benefits.